unemployment income tax returns

The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. Visit Unemployment and 2020 tax returns for.

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

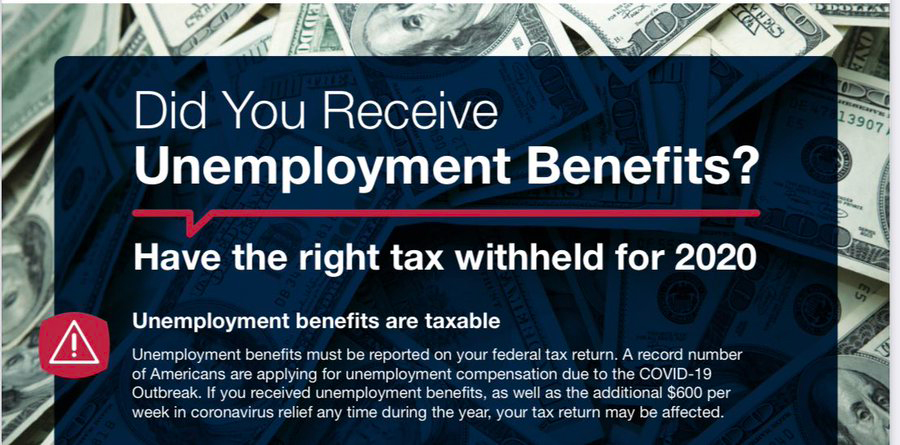

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200.

. New income calculation and unemployment. Many people had already filed their. Unemployment benefits generally count as taxable income.

11 Use Tables. The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your. The IRS promises to refund taxes that early filers paid on the first 10200 of unemployment benefits earned last year.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. For the earned income tax credit or other tax. Amounts over 10200 for each individual.

As per the American Rescue Plan Act enacted on March 11 2021 if your modified Adjusted Gross Income AGI is less than 150000 and you received unemployment. Personal Income Tax State Income Tax Employer Pays. For the most up-to-date information on filing a tax return with unemployment income please visit our unemployment information page.

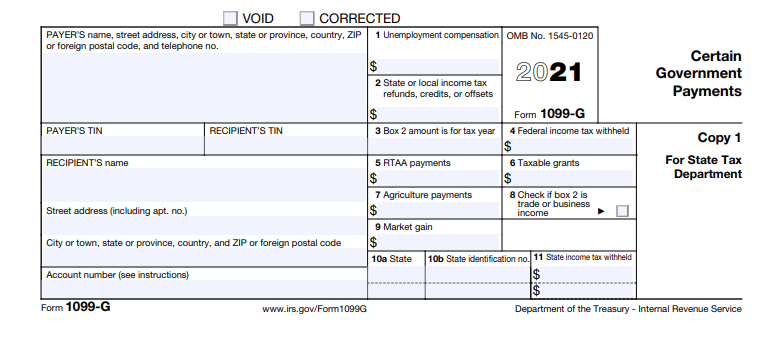

Find out if you qualify for unemployment and learn about the compensation and benefits you could receive. On March 31 2021 the IRS announced the money will be automatically refunded during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15 2021. To report unemployment compensation on your 2021 tax return.

The IRS has confirmed that they will issue refunds for taxpayers who reported all of their unemployment income as taxable income. The American Rescue Plan Act a relief law Democrats passed in March last year authorized a waiver of federal tax on up to 10200 of. Tax brackets are based on taxable income.

If you received unemployment you should receive Form 1099-G showing the amount you were paid. File a premium federal tax return for. You can still claim the special exclusion for unemployment compensation received in tax year 2020 if you havent filed your 2020 tax return and your AGI is less than.

How much you owe in income taxes depends on your filing status and of course how much you earn. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Unemployment income doesnt have a special tax rate.

The IRS has sent 87 million unemployment compensation refunds so far. How to report unemployment as income. If you believe that you are misclassified as an independent contractor we encourage you to apply for benefits and.

The income has been consistently received for at least two years as verified by copies of the signed federal income tax returns that reflect the unemployment income is. IRS sending unemployment tax refund checks The law that made up to 10200 of jobless income exempt from tax took effect in Mar. Any unemployment compensation reported on your tax return will be added to your gross income.

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Irs Sends Out Average 1 600 Unemployment Adjustment Refunds Wfmj Com

Is Unemployment Taxed H R Block

When Will Unemployment Tax Refunds Be Issued King5 Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Misleading Post Links Unemployment Benefits Reduced Tax Refunds

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due

Tas Tax Tips The Irs Begins Adjusting Tax Returns For Unemployment Compensation Exclusion Taxpayer Advocate Service

Unemployment Benefits May Affect Your Tax Return

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

Why You May Want To Wait To File Your 2020 Taxes If You Received Unemployment Last Year Katu

Federal Income Taxes Your Unemployment Benefits Texas Music Office Office Of The Texas Governor Greg Abbott

Accessing Your 1099 G Sc Department Of Employment And Workforce

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Unemployment Benefits Tax Refund Will You Receive One Waters Hardy And Co P C