are hoa fees tax deductible for home office

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. So while the HOA fees are non-deductible for how the house is used do not worry as there are some other fees instead which can be deducted depending on different factors.

Are Hoa Fees Tax Deductible The Handy Tax Guy

Yes you can write off hoa fees if you use your home as an office.

. It depends but usually no. You can also deduct. If you are self-employed.

Additionally if you use the home as your primary. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property. The answers not as straightforward as you might think.

Are hoa fees tax deductible. Is your hoa fee tax deductible. You can also deduct 10 of your.

You can deduct certain expenses including HOA fees related to your home office. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property. Is your hoa fee tax deductible.

Unfortunately homeowners association HOA fees paid on your personal residence are not deductible. The IRS considers HOA fees as a rental expense which means you can write them off from. The short answer is.

If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property. The IRS considers HOA fees as a rental expense which means you can write them off from your. If you are self-employed and work primarily in your home you can deduct a part of your HOA fee through your home office deductions.

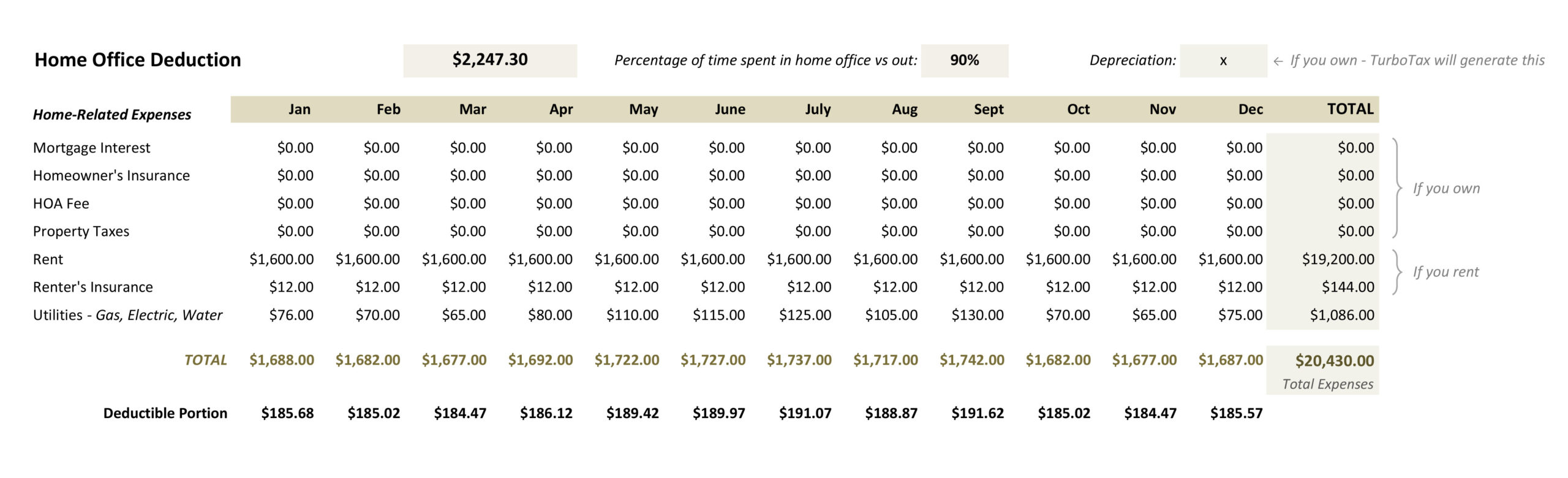

Yes you can write off HOA fees if you use your home as an office. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. The amount deducted corresponds with the size of your.

If you are self-employed and have a home office you can deduct some of your expenses related to that home office including HOA fees. Is your hoa fee tax deductible. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities.

Generally if you are a first time homebuyer your hoa fees will almost never be tax. Yes HOA fees are deductible for home offices. Yes you can include a portion of your HOA and mortgage interest if you are eligible to claim a home office expense.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. June 6 2019 803 AM. This is an exception to the rule.

However if you have an office in your home that you use in connection with. The amount deducted corresponds with. Yes HOA fees are deductible for home offices.

If you are self-employed and work primarily in your home you can deduct a part of your HOA fee through your home office deductions. Before claiming your HOA fees you will have to determine how much space your home office takes up in your house. Before claiming your HOA fees you will have to determine how much space your home office takes up in your house.

In general HOA fees are considered a part of your monthly housing costs and are not tax deductible. For first-time homebuyers your HOA fees are almost never tax deductible.

Are Hoa Fees Tax Deductible Clark Simson Miller

Can I Write Off A Home Office Deduction For Delivery Or Rideshare

Can You Take A Home Office Tax Deduction Virblife Com

What Is A Homeowners Association And How Much Are Hoa Fees Windermere Real Estate

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Home Office Deduction Explained How To Write Off Home Office Expenses Save On Taxes Youtube

Tax Season Tips How To Get A Home Office Deduction

Amazon Com Mlm Home Office Tax Deductions Are Huge Tax Breaks For Network Marketers Book 3 Ebook Mueller Ronald R Allen Robert Kindle Store

Are Hoa Fees Tax Deductible Cedar Management Group

2022 Tax Deductions And Credits For Household Expenses Smartasset

Can I Write Off Hoa Fees On My Taxes

An Easy Guide To The Home Office Deduction

Home Office Deduction Explained Write Off Save On Taxes

The Truth About The Home Office Deduction Mark J Kohler

Can You Claim The Home Office Tax Deduction If You Ve Been Working Remotely Here S Who Qualifies Marketwatch

How Does The Home Office Deduction Work